Shopper Aid: Seek out a supplier which offers focused aid, including usage of educated specialists who will respond to questions on compliance and IRS guidelines.

Better Service fees: SDIRAs often include better administrative costs compared to other IRAs, as specific elements of the administrative process can't be automated.

Entrust can support you in buying alternative investments using your retirement resources, and administer the obtaining and promoting of assets that are typically unavailable via financial institutions and brokerage firms.

The tax advantages are what make SDIRAs eye-catching For several. An SDIRA might be each conventional or Roth - the account form you select will rely largely in your investment and tax system. Verify with your money advisor or tax advisor if you’re Not sure that is finest in your case.

While there are many Advantages connected to an SDIRA, it’s not devoid of its individual downsides. Several of the common main reasons why traders don’t choose SDIRAs include things like:

Restricted Liquidity: Lots of the alternative assets which can be held in an SDIRA, which include property, non-public fairness, or precious metals, is probably not conveniently liquidated. This may be a difficulty if you might want to accessibility money promptly.

Including funds straight to your account. Understand that contributions are issue to annual IRA contribution limitations set because of the IRS.

Lots of buyers are astonished to learn that using retirement funds to invest in alternative assets has actually been probable because 1974. Having said that, most brokerage firms and banking institutions center on supplying publicly traded securities, like shares and bonds, because they lack the infrastructure and expertise to manage privately held assets, such as property or personal fairness.

Number of Investment Alternatives: Ensure the supplier allows the kinds of alternative investments you’re interested in, like property, precious metals, or private fairness.

And since some SDIRAs including self-directed regular IRAs are subject matter to required least distributions (RMDs), you’ll must strategy in advance to make certain you've plenty of liquidity to meet The principles set because of the IRS.

Producing essentially the most of tax-advantaged accounts helps you to maintain additional of The cash which you commit and gain. Determined by irrespective of whether you choose a standard self-directed IRA or a self-directed Roth IRA, you have got the probable for tax-totally free or tax-deferred development, offered particular conditions are fulfilled.

Believe your Buddy might be setting up another Facebook or Uber? With the SDIRA, you can spend money on brings about that you believe in; and likely appreciate better returns.

Greater investment options means you can diversify your portfolio outside of stocks, bonds, and mutual funds and hedge your portfolio against market fluctuations and volatility.

An SDIRA custodian differs as they have the suitable staff, abilities, and capability to maintain custody of your alternative investments. Step one in opening a self-directed IRA is to locate a provider that is definitely specialized in administering accounts for alternative investments.

The most crucial SDIRA principles within the IRS that investors require to comprehend are investment limits, disqualified individuals, and prohibited transactions. Account holders should abide by SDIRA principles and rules as a way to protect the tax-advantaged standing in their account.

Complexity and Obligation: Having an SDIRA, you may have much more Management above your investments, but You furthermore mght bear much more duty.

Relocating resources from one sort of account to a different sort of account, which include moving cash from a 401(k) to a standard IRA.

Being an investor, however, your choices will not be restricted to stocks and bonds if you end up picking to self-direct your retirement accounts. That’s why an SDIRA can transform your portfolio.

Be in command of how you develop your retirement portfolio by utilizing your specialised knowledge and interests to take a position in assets that in shape with all your values. Got click resources expertise in housing or non-public equity? Use it to guidance your retirement planning.

Michael Bower Then & Now!

Michael Bower Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Rachael Leigh Cook Then & Now!

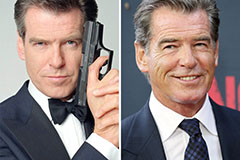

Rachael Leigh Cook Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!